Table of Content

This new device makes it straightforward to seek out and compare monetary advisors. In a number of simple steps, get matched with up to three native fiduciary monetary advisors who've passed a rigorous screening process. Hence, if John opts for an annuity, then he would receive $38,635.eighty two. Use the next information for the calculation of the present value of an annuity. Use the following knowledge for the calculation of the PV of an annuity. Press CALCULATE and you’ll see the present value of the cash you’ve been squirrelling away.

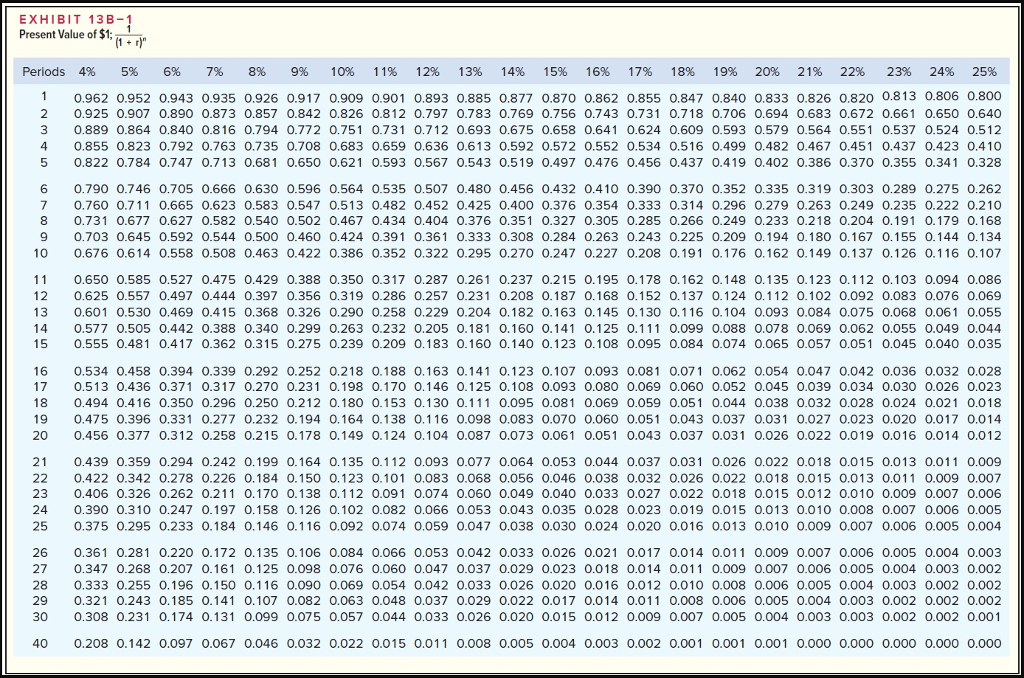

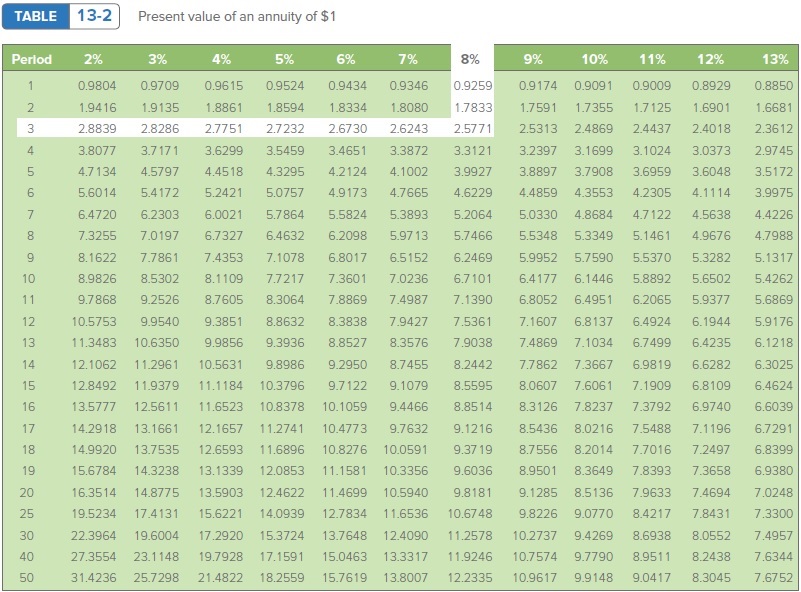

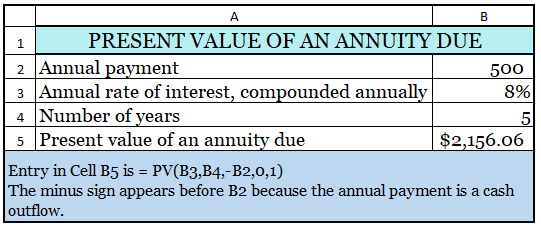

If annuity payments are due initially of the period, the funds are referred to as an annuity due. To calculate the current worth interest factor of an annuity due, take the calculation of the current worth interest issue and multiply it by (1+r), with "r" being the discount price. If you own an annuity or obtain money from a structured settlement, you might select to sell future funds to a purchasing firm for instant money.

Erisa Regulated Plans

Annuity means a stream or collection of equal funds; for example, you may have made an investment that can generate an curiosity income of $5,000 for you on the end of every year for 5 years. The calculation of PVIFA relies on the concept of the time worth of cash. This idea stipulates that the value of currency obtained at present is value greater than the worth of currency acquired at a future date. This is as a result of the forex received at present could also be invested and can be used to generate interest. Present Value Of An Annuity – Based in your inputs, that is the current value of the annuity you entered information for. The present worth of any future worth lump sum and future cash flows .

Payment/Withdrawal Amount – This is the entire of all funds acquired or made receives on the annuity. This is a stream of funds that occur in the future, acknowledged in phrases of nominal, or at present's, dollars. Present worth calculations may be complicated to mannequin in spreadsheets as a end result of they contain the compounding of interest, which suggests the curiosity in your cash earns interest. Fortunately, our present worth annuity calculator solves these issues for you by changing all the mathematics headaches into level and click simplicity.

Present Value Of A Growing Annuity (g ≠ I)

If you might have a 401, you’ll want to know the doubtless worth of that account when you retire. That means that when you ultimately start making withdrawals, the quantity you contributed to the annuity is not taxed, though your earnings are taxed at your common earnings tax price. Before we cover the current value of an annuity, let’s first evaluate what an annuity is exactly. An annuity is a contract you enter into with a monetary company where you pay a premium in trade for payments afterward. For a present value of $1000 to be paid one 12 months from the initial investment, at an interest rate of 5 p.c, the initial funding would have to be $952.38.

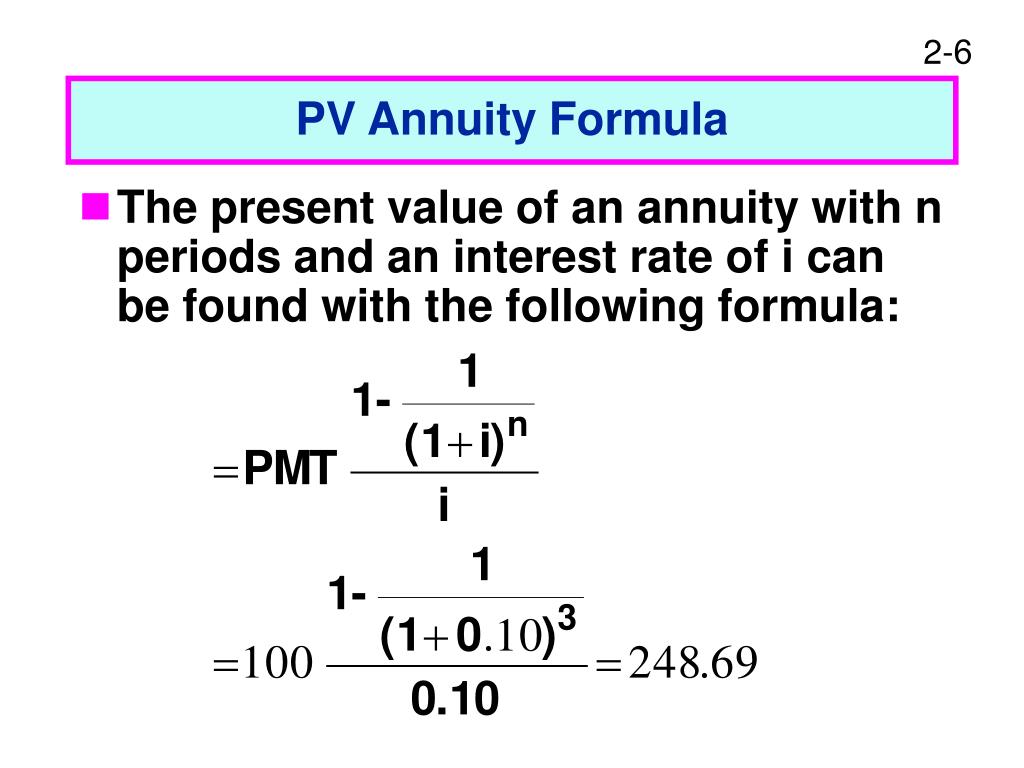

You can calculate the present or future worth for an ordinary annuity or an annuity due utilizing the following formulas. The future value of an annuity is the entire value of funds at a particular time limit. The bonds will generate an interest earnings of $25,000 annually for 5 years. It is predicated on the time value of cash, which states that the value of a currency obtained at present is price greater than the identical worth of forex acquired at a future date.

You could end up wondering in regards to the present value of the annuity you’ve purchased. The current worth of an annuity is the total cash value of all your future annuity payments, given a determined rate of return or low cost fee. Knowing the present worth of an annuity may help you determine precisely how a lot worth you might have left in the annuity you purchased.

These annuities pay cash to you after you fulfill the obligations of the contract. Annuities normally defer taxes on funding positive aspects but then tax withdrawals from the annuity at ordinary income rates. They also typically contain a death benefit within the event you die and are unable to withdraw the cash as income at retirement. Perpetuity, in finance, is a constant stream of equivalent cash flows with no end, such as payments from an annuity. Future worth is the value of a current asset at a future date based on an assumed rate of progress. It is necessary to buyers as they will use it to estimate how a lot an funding made right now might be value in the future.

Understanding Current Worth Curiosity Issue Of Annuity

For instance, the present-value method could be used to determine how a lot to invest now if you want to guarantee annual payments of $1,000 for 10 years. To achieve a $1,000 annuity cost for 10 years with interest rates at 8%, you'd want to speculate $6,710.08 at present. The calculation of each current and future value assumes a regular annuity with a onerous and fast development price. Many on-line calculators decide both the present and future value of an annuity, given its rate of interest, payment quantity, and period. To calculate the present value of an annuity, you will need to know the rate of interest, the size of time until the payments are received, and the quantity of each fee.

You can easily discover on-line calculators that can do the legwork for you. Specifically, this is used to measure the present price of a stream of equal payments that will take place at a future interval. Once you do a little math, you’ll discover out that this can come out to $311,555. As you'll be able to tell, the value of the annuity is value greater than the $300,000 lump sum. So, on this case, it makes extra monetary sense to take the annuity funds.

David Kindness is a Certified Public Accountant and an professional in the fields of economic accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped hundreds of clients improve their accounting and financial methods, create budgets, and decrease their taxes. On the opposite hand, if the money flow is to be acquired on the end of every period, then the formula for the present value of an ordinary annuity could be expressed as proven under. Using the above method, you'll be able to determine the present worth of an annuity and determine if taking a lump sum or an annuity fee is a extra efficient choice. It is essential as a outcome of capital expenditure requires a substantial quantity of funds. Bonds are sometimes ordinary annuities as a outcome of they are paid at the end of a period.

A automotive cost or house payment could be good examples of an annuity due. You make a payment on the first of each month, and every month thereafter on the same date, until the tip of the outlined term. Have you been making ready for retirement by making common deposits into an account?

When t approaches infinity, t → ∞, the variety of funds approach infinity and we now have a perpetual annuity with an higher limit for the present value. You can show this with the calculator by rising t till you're convinced a restrict of PV is actually reached. Then enter P for t to see the calculation outcome of the actual perpetuity formulation. FYI, the lower the low cost price you obtain, the higher the current value your annuity has. Also, low low cost charges allow you to keep even more of your hard-earned cash. Just observe that what quote the calculator shows isn’t set-in-stone.

No comments:

Post a Comment